top of page

RedotPay Service Overview

RedotPay is a comprehensive fintech platform that enables everyday payments and remittances with cryptocurrency.

Users can use their dedicated cryptocurrency card to pay for cryptocurrencies directly at over 130 million Visa merchants worldwide, with cryptocurrencies paid out immediately without the need for a separate currency exchange.

RedotPay supports major cryptocurrencies and stablecoins such as BTC, ETH, USDC, USDT, and allows you to deposit assets from multiple blockchain networks such as Solana, Polygon, BSC, Tron, and Arbitrum.

It also features a single account to manage multi-currency wallets, real-time conversion between crypto assets and fiat currencies, and onramp/offramp (deposit/withdrawal) functions all in one place.

We provide services in over 158 countries around the world, and new users can immediately issue a virtual card and apply for a physical card after installing the app, creating an account, and completing KYC identity verification.

(For Korean users, you can use the service after KYC verification using your passport or resident registration card, and a virtual card issuance fee of $10 and a physical card issuance fee of $100 will be charged.)

Key features of RedotPay:

Cryptocurrency Debit/Credit Card: Supports real-life payments with a Visa card backed by crypto assets. Linkable to Apple Pay/Google Pay, and also supports ATM cash withdrawals.

Deposit/Withdrawal Wallet Service: Supports deposits (charging) and withdrawals (transfers) of various cryptocurrencies. You can move funds with fast deposits/withdrawals and low fees.

Global remittances and payments: Provides the ability to instantly convert crypto assets into local currency for international remittances or use for overseas payments (some features will be released sequentially)

For example, in Brazil, we have launched a service to send money to local BRL accounts in cryptocurrency, with an average processing time of 10 minutes.Multi-currency Accounts: For users in some regions, we also offer a Currency Account, which allows you to hold fiat currency balances such as EUR or GBP.

(Currently available for Europe/UK, KRW accounts are not supported)Security and Compliance: We have the highest level of security measures in place, including two-factor authentication (2FA), biometric login, and real-time KYT transaction monitoring, and we manage user assets through a custodian licensed by the Hong Kong Monetary Authority.

User assets are segregated from company assets and protected by $42 million in insurance.

.png)

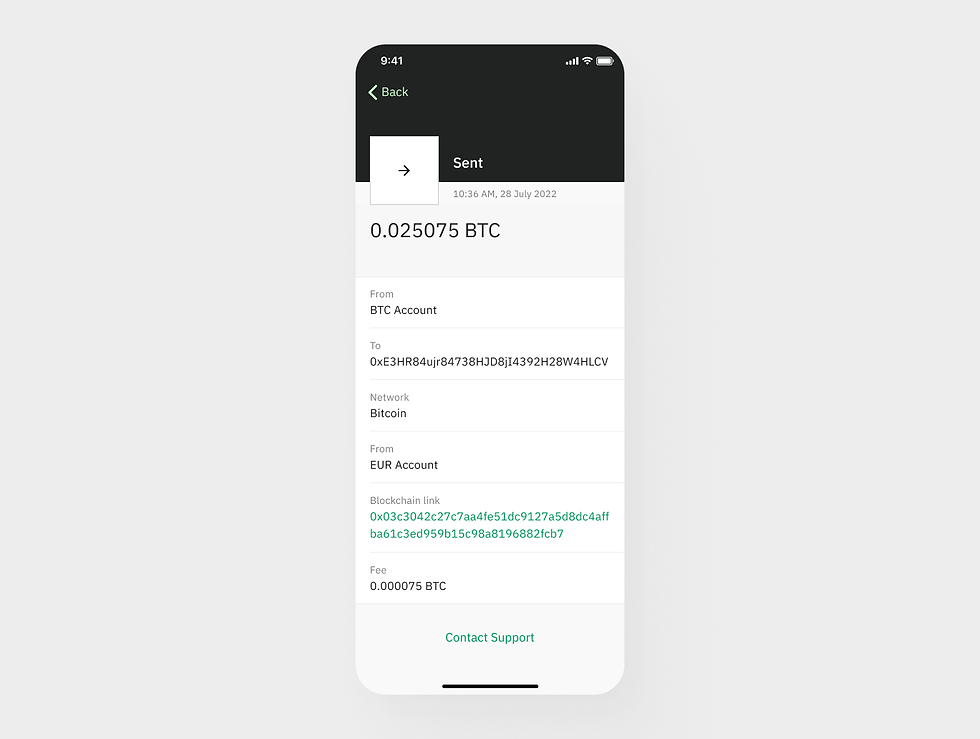

Once you're on the main 'Dashboard', click the 'Send' button or go to 'Accounts', select 'Cryptocurrency', and then select the currency you wish to withdraw.

.png)

After selecting a currency, click the "Send" button and select the network you want to use for the transaction.

.png)

Enter the recipient's information (address, unique note, destination tag, etc.) or scan the QR code. Ensure the address is correct and compatible with the cryptocurrency you wish to withdraw. Then, click "Continue."

.png)

Next, enter the amount you wish to withdraw. Double-check all information you entered, including the amount and recipient address. Click "Confirm" and enter the OTP code sent to you via SMS.

.png)

Once the withdrawal is confirmed on the blockchain network, the cryptocurrency will be transferred to the external wallet address you entered. The time it takes for the cryptocurrency to arrive in your external wallet may vary depending on network speed and the cryptocurrency's confirmation requirements.

.png)

Minimum and maximum withdrawal amounts and network fees may vary for each cryptocurrency. Therefore, it's important to check these details before making a withdrawal to avoid any unexpected consequences.

If you encounter any issues while withdrawing cryptocurrency from your Wirex account, please contact our customer support team for assistance.

How to Activate Your Wirex Card

( ATM cash withdrawal )

Activating your physical card is a crucial step before using it. This article will guide you through the Wirex card activation process.

Before you begin, make sure you've received and have your Wirex card. Now, follow these simple steps.

Step 1: Log in to the Wirex app

Open the Wirex app and log in using your account information. If you haven't already downloaded the app, you can download it from the App Store or Google Play Store.

Step 2: Go to the "Cards" section.

After logging in, go to the "Cards" section of the app. Here, you can view all available cards.

Step 3: Activate your Wirex card

Select the card you want to activate and click "Activate." A screen will appear asking you to confirm receipt of the card and agree to the terms and conditions.

Step 4: Verify your card information

To verify your card, you'll need to enter basic information, including your card number and expiration date. Please ensure you enter your information accurately and double-check before submitting.

Step 5: Set up a PIN (Visa only)

Once your card is authenticated, you'll be prompted to set a PIN. This is a four-digit number used to authorize card transactions. Choose a PIN that's easy for you to remember, but difficult for others to guess.

Step 6: Link your account

Follow the instructions to select the account you want to use with your card. Your card must have at least one fiat account linked to it.

Step 7: Start using your card!

Congratulations! Your Wirex card is activated and ready to use. You can use your Wirex card to make purchases online or in-store, withdraw cash from ATMs, and more.

In conclusion, activating your Wirex card is a quick and easy process. Just follow the steps above and you'll be ready to use it in no time. If you encounter any issues during the activation process, please contact our customer support team at any time.

Note: Before making contactless payments with your VISA card, you must activate your card through a Chip & PIN transaction in-store.

Insert your card into the payment terminal and enter your PIN to complete your purchase.

Once your first transaction is complete, contactless payments will be enabled and you can tap to pay at supported terminals.

We'll help you get the most out of your Wirex card!

bottom of page